The Effect of Excise Tax Stamps on Total Sales and Net Profit: A Case Study of PT. Gudang Garam Tbk and PT Hanjaya Mandala Sampoerna Tbk

DOI:

https://doi.org/10.37012/ileka.v6i2.3173Abstract

This study aims to analyze the influence of excise stamps and total sales on net profit at PT Gudang Garam Tbk (GGRM) and PT HM Sampoerna Tbk (HMSP), the two largest cigarette companies in Indonesia. Using a quantitative approach based on secondary data from financial reports during the study period, this study processed the variables of excise stamps, total sales, and net profit through multiple linear regression after natural logarithm transformation and classical assumption tests. Data were analyzed to test the partial and simultaneous effects of the independent variables on the dependent variable. The results showed that excise stamps had a negative and significant effect on the company's net profit, confirming that increasing excise burdens are a factor that can suppress the profitability of the cigarette industry. Meanwhile, total sales had a positive and significant effect on net profit, indicating that increasing sales volume can improve the company's financial performance despite facing high excise burdens. Simultaneously, both variables also had a significant effect with an R Square value of 0.593. These findings confirm that excise burdens and sales performance are important factors in determining the profitability of cigarette companies in Indonesia. Meanwhile, sales growth is an important strategy to maintain profits. The research results are expected to serve as a reference for industry, academics, and the government in formulating business strategies and fiscal policies in the tobacco sector.

Downloads

Published

Issue

Section

Citation Check

License

Copyright (c) 2025 Louis Lim, Shelinda Oktaviani, Elizabeth Tiur Manurung

This work is licensed under a Creative Commons Attribution 4.0 International License.

Jurnal Ilmu Ekonomi Manajemen dan Akuntansi (ILEKA) Universitas Mohammad Husni Thamrin allows readers to read, download, copy, distribute, print, search, or link to the full texts of its articles and allow readers to use them for any other lawful purpose. The journal allows the author(s) to hold the copyright without restrictions. Finally, the journal allows the author(s) to retain publishing rights without restrictions Authors are allowed to archive their submitted article in an open access repository Authors are allowed to archive the final published article in an open access repository with an acknowledgment of its initial publication in this journal.

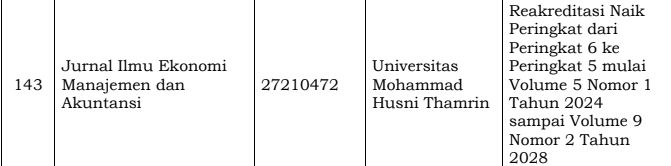

Jurnal Ilmu Ekonomi Manajemen Akuntansi (ILEKA) Mohammad Husni Thamrin is licensed under a Creative Commons Attribution 4.0 International License.