The Effect of Capital Structure on Business Risk as Measured Through the EBIT Variation Coefficient in Leading Food Companies on the IDX in the Post-Covid-19 Period of 2021–2023

DOI:

https://doi.org/10.37012/ileka.v6i2.3156Abstract

The post-COVID-19 pandemic period of 2021–2023 has brought significant changes to the business world, including the food industry, which had previously been considered relatively stable and resilient to crises. This situation requires companies to adopt adaptive financial management, particularly in terms of capital structure. Capital structure, the balance of debt and equity funding, is a strategic aspect that determines a company's ability to maintain liquidity, operational flexibility, and profit stability. This study aims todetermine the effect of capital structure on business risk infood companies listed on the Indonesia Stock Exchange in the post-pandemic period.Business risk is measured using the EBIT Variation Coefficient, while capitalstructure is measured using the leverage ratio. The analysis is conducted usinglinear regression with a series of classical assumption tests. The results show thatcapital structure has a positive and significant effect on business risk. The results of thet-test indicate that capital structure has a significant effect with a t-value of1.902 and a significance value of 0.023. The F-test also shows that the regression model issignificant with a significance value of 0.002, making the model suitable for use.Meanwhile, the coefficient of determination R² value of 0.195 shows thatcapital structure can explain 19.5% of business risk, while the rest isinfluenced by other factors outside the model. This finding confirms that the higherthe level of debt usage, the greater the risk of EBIT fluctuations that must beborne by the company.

Downloads

Published

Issue

Section

Citation Check

License

Copyright (c) 2025 Grace Natalia Tjahjadi, Elizabeth Tiur Manurung

This work is licensed under a Creative Commons Attribution 4.0 International License.

Jurnal Ilmu Ekonomi Manajemen dan Akuntansi (ILEKA) Universitas Mohammad Husni Thamrin allows readers to read, download, copy, distribute, print, search, or link to the full texts of its articles and allow readers to use them for any other lawful purpose. The journal allows the author(s) to hold the copyright without restrictions. Finally, the journal allows the author(s) to retain publishing rights without restrictions Authors are allowed to archive their submitted article in an open access repository Authors are allowed to archive the final published article in an open access repository with an acknowledgment of its initial publication in this journal.

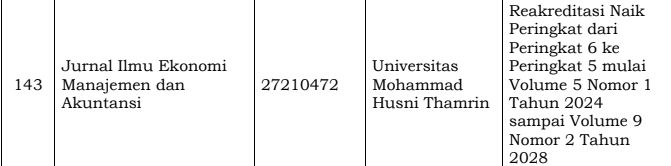

Jurnal Ilmu Ekonomi Manajemen Akuntansi (ILEKA) Mohammad Husni Thamrin is licensed under a Creative Commons Attribution 4.0 International License.