The Effect of Changes in Long-Term Liabilities on the Share Price of PT Kalbe Farma Tbk

DOI:

https://doi.org/10.37012/ileka.v6i2.3136Abstract

This study aims to examine the effect of long-term liabilities on the stock price of PT Kalbe Farma Tbk during the 2017–2024 period using a simple linear regression approach. The long-term liabilities variable was analyzed to determine its contribution to variations in stock price based on the company’s historical financial data. The results indicate a negative regression coefficient of –1.82849 × 10⁻¹⁰, suggesting that an increase in long-term liabilities tends to be associated with a decline in stock price. However, the p-value of 0.3860 reveals that this relationship is not statistically significant at the 5 percent significance level. This finding is further supported by the ANOVA results, which show a Significance F value of 0.3860, confirming that the regression model as a whole does not have explanatory power. The coefficient of determination (R Square = 0.0269) demonstrates that only 2.69% of the stock price variability can be attributed to changes in long-term liabilities, while the remaining portion is influenced by other factors such as macroeconomic conditions, market sentiment, and the company’s operational performance. The negative coefficient aligns with capital structure theory, the principle of accounting conservatism, and Signaling Theory, indicating that increases in long-term obligations may raise investors’ perceptions of risk. Nonetheless, the statistical insignificance suggests that long-term liabilities are not a key determinant considered by investors when evaluating the stock price of PT Kalbe Farma Tbk.

Downloads

Published

Issue

Section

Citation Check

License

Copyright (c) 2025 Madeline Guenevere Pranoto, Heavenly Melodious, Elizabeth Tiur Manurung

This work is licensed under a Creative Commons Attribution 4.0 International License.

Jurnal Ilmu Ekonomi Manajemen dan Akuntansi (ILEKA) Universitas Mohammad Husni Thamrin allows readers to read, download, copy, distribute, print, search, or link to the full texts of its articles and allow readers to use them for any other lawful purpose. The journal allows the author(s) to hold the copyright without restrictions. Finally, the journal allows the author(s) to retain publishing rights without restrictions Authors are allowed to archive their submitted article in an open access repository Authors are allowed to archive the final published article in an open access repository with an acknowledgment of its initial publication in this journal.

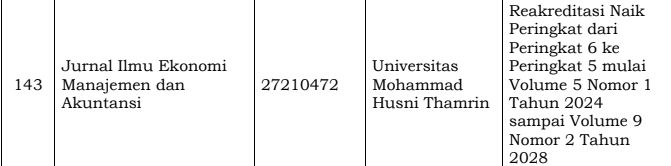

Jurnal Ilmu Ekonomi Manajemen Akuntansi (ILEKA) Mohammad Husni Thamrin is licensed under a Creative Commons Attribution 4.0 International License.