Pengaruh Prinsip Character, Capacity, Capital, Collateral, Condition Of Economy Terhadap Pengambilan Keputusan Kredit PT. Bank Negara Indonesia KCU Cibinong Tahun 2020

DOI:

https://doi.org/10.37012/ileka.v1i2.308Keywords:

Character, Capacity, Capital, Collateral, Condition of Economy, Keputusan KreditAbstract

Bank Is A Financial Intermediary Institution Generally Established With The Authority To Manage Money Deposits. In Giving Credit There Are Several Things That Are Associated With Good Faith (Willingness To Pay) And Ability To Pay (Ability To Pay). Having the Problem Formulation Above Analyzing the Influence of These Factors is Very Important, namely "The Influence of Principles (Character, Capacity, Capital, Collateral, and Condition Of Economy) on Credit Decision Making at Pt. Bank Negara Indonesia Kcu Cibinong Year 2020", the theoretical basis used is the Theory of Credit Elements, Credit Provision Procedures, Identification, Legalization and Credit Realization Stages. This Research Uses Quantitative Methods With Results Showing That Character, Capacity, Capital, Collateral, Condition Of Economy Has A Significant Coefficient Of 0.000 < 0.005 And Fcount 27.041 > Ftable 3.33 It Can Be Concluded That Ha Stating With Character, Capacity, Capital, Collateral , And The Condition Of Economy Simultaneously Significantly Affects Credit Decision Making. The Principle of Character, Capacity, Capital, Collateral, Condition Of Economy Has No Significant Influence on Credit Decision Making. And Simultaneously Character, Capacity, Capital, Collateral, Condition Of Economy Significantly Affect Credit Decision Making.

Keywords: Character, Capacity, Capital, Collateral, Condition Of Economy, Credit Decision.

References

Suparwoto, Pengantar Akuntansi, Jakarta : Quadrand Publishing, 2013

Khasmir, Bank : Studio Belajar, 2015

Karmila, Kredit Bank, Yogyakarka : Kompetensi Terapan Sinergi Pustaka, 2015

Mangani, Silvanita, Ktut, 2009, “Bank dan Lembaga Keuangan Lainâ€, Penerbit Erlangga, Jakarta.

Mishkin, S., Frederic, 2008’ “Ekonomi Uang, Perbankan, dan Pasar Uangâ€, Edisi Kedelapan, Salemba Empat, Jakarta.

Sugiyono, Statiska Penelitian, Jakarta : Lentera Ilmu Cendekia, 2017

Sudaryono, Aplikasi Statiska Untuk Penelitian: Tanggerang, 2015

Sedarmayanti, Statiska, Yogyakarta : KTSP, 2015

Ghazali, Metedologi Penelitian, BBS, 2012

Veithzal Rivai dan Adriana Permata Veithzal. (2007) Credit Management Handbook Teori, konsep, Prosedur dan aplikasi Paduan Praktis, Bankir dan Nasabah. Jakarta: Rajagrafindo Persada.

Veithzal Rivai dan Adriana Permata Veithzal (2008) Islamic Financial Management, Teori, konsep dan aplikasi Paduan Praktis untuk Lembaga Keuangan, Nasabah, praktis dan Mahasiswa. Jakarta: Rajagrafindo Persada.

Downloads

Published

Issue

Section

Citation Check

License

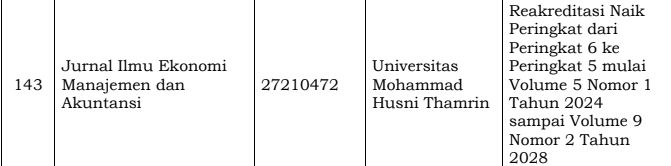

Jurnal Ilmu Ekonomi Manajemen dan Akuntansi (ILEKA) Universitas Mohammad Husni Thamrin allows readers to read, download, copy, distribute, print, search, or link to the full texts of its articles and allow readers to use them for any other lawful purpose. The journal allows the author(s) to hold the copyright without restrictions. Finally, the journal allows the author(s) to retain publishing rights without restrictions Authors are allowed to archive their submitted article in an open access repository Authors are allowed to archive the final published article in an open access repository with an acknowledgment of its initial publication in this journal.

Jurnal Ilmu Ekonomi Manajemen Akuntansi (ILEKA) Mohammad Husni Thamrin is licensed under a Creative Commons Attribution 4.0 International License.