Investment Decision Analysis Using the Stochastic Oscillator and Moving Average Convergence Divergence (MACD) Indicators at Indofood Company

DOI:

https://doi.org/10.37012/ileka.v6i2.2980Abstract

This research aims to analyze the stock investment decisions of PT. Indofood Sukses Makmur Tbk (INDF) uses Moving Average Convergence Divergence and stochastic oscillator indicators. The research methodology used is a qualitative method with the type of panel data (time series) obtained from the Indonesia Stock Exchange. The sampling technique uses purposive sampling method with daily data and research periods from 2020. The data analysis technique used is technical analysis using the Moving Average Convergence Dicergence Indicator and Stochastic Oscillator to determine buy & sell signals with the help of the Chart Tradingview program to find out the level of accuracy of both technical indicators on the stock to be invested. The results of this study show that the price movement of PT. Indofood Sukses Makmur Tbk (INDF) using the Moving Average Convergence Divergence (MACD) indicator and Stochastic Oscillator indicator 2020. The results of the study contained a total of 4 (four) Buy signals and 4 (four) Sell signals. With an accuracy rate of 100% during the 2020 period. Meanwhile, the level of risk and return generated using the Moving Average Convergence Divergence and Stochastic Oscillator indicators during the 2020 period on INDF shares obtained a risk of Rp 0 or 0% with a return of Rp 3,550 or 64.79 %.

Downloads

Published

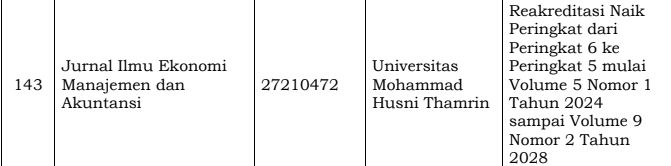

Issue

Section

Citation Check

License

Copyright (c) 2025 Putu Tirta Sari Ningsih, Muhammad Gusvarizon, Febi Febriansyah

This work is licensed under a Creative Commons Attribution 4.0 International License.

Jurnal Ilmu Ekonomi Manajemen dan Akuntansi (ILEKA) Universitas Mohammad Husni Thamrin allows readers to read, download, copy, distribute, print, search, or link to the full texts of its articles and allow readers to use them for any other lawful purpose. The journal allows the author(s) to hold the copyright without restrictions. Finally, the journal allows the author(s) to retain publishing rights without restrictions Authors are allowed to archive their submitted article in an open access repository Authors are allowed to archive the final published article in an open access repository with an acknowledgment of its initial publication in this journal.

Jurnal Ilmu Ekonomi Manajemen Akuntansi (ILEKA) Mohammad Husni Thamrin is licensed under a Creative Commons Attribution 4.0 International License.