The Effect of Current Ratio, Price to Book Value, and Debt to Equity Ratio on Return on Assets (in Food and Beverage Companies Listed on the Indonesia Stock Exchange in 2021-2023)

DOI:

https://doi.org/10.37012/ileka.v6i2.2969Abstract

The food and beverage industry is a strategic sector that makes a significant contribution to the national economy. This growth is inseparable from the increasing population, increasingly widespread urbanization, and changes in people's lifestyles, which tend to prefer ready-to-eat food and practical drinks. Furthermore, the development of digital technology, particularly e-commerce and food delivery services, has opened up significant opportunities for companies to reach a wider market without geographical limitations. This study aims to determine the effect of the Current Ratio, Price to Book Value, and Debt to Equity Ratio on Return on Assets (in Food and Beverage Companies Listed on the Indonesia Stock Exchange in 2021-2023). The method used is quantitative descriptive analysis. The data used is secondary data in the form of annual financial reports obtained from the official website of the Indonesia Stock Exchange. The analytical technique used is multiple linear regression analysis to test the effect of each independent variable on the dependent variable. The results of the study show that partially, Current Ratio does not have a significant effect on ROA, Price to Book Value does not have a significant effect on ROA, Debt to Equity Ratio has a negative and significant effect on ROA. These findings provide implications for investors and management of Food and Beverage companies in considering the company's financial structure and operational efficiency in increasing profitability.

Downloads

Published

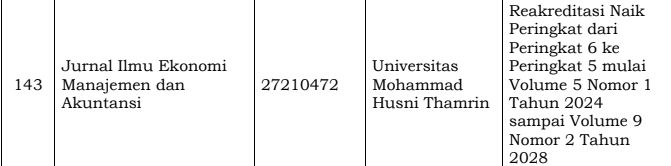

Issue

Section

Citation Check

License

Copyright (c) 2025 Annisa Dera, Sutrisno, Reni Febrianti

This work is licensed under a Creative Commons Attribution 4.0 International License.

Jurnal Ilmu Ekonomi Manajemen dan Akuntansi (ILEKA) Universitas Mohammad Husni Thamrin allows readers to read, download, copy, distribute, print, search, or link to the full texts of its articles and allow readers to use them for any other lawful purpose. The journal allows the author(s) to hold the copyright without restrictions. Finally, the journal allows the author(s) to retain publishing rights without restrictions Authors are allowed to archive their submitted article in an open access repository Authors are allowed to archive the final published article in an open access repository with an acknowledgment of its initial publication in this journal.

Jurnal Ilmu Ekonomi Manajemen Akuntansi (ILEKA) Mohammad Husni Thamrin is licensed under a Creative Commons Attribution 4.0 International License.